Why The U.S. Is Facing a Diesel and Heating Oil Shortage

Spoiler alert: bad political decisions are the blame.

Crude oil supply constraints and declining refinery capacity have led to an impending shortage of diesel fuel and heating oil in the United States this winter, especially on the East Coast. Diesel stocks in the Northeast Home Heating Oil Reserve (NHHOR), which originally contained 2 million barrels of No. 2 heating oil but was converted to 1 million barrels of ultra-low sulfur diesel (ULSD) 10 years ago, are down to a 20-day supply, according to the EIA. (Note: No. 2 heating oil and ULSD are chemically the same except for the sulfur content and diesel is taxed as road fuel and is a clear green color while No. 2 heating oil is tax-free and is stained red by EPA rule. A truck caught with red-stained fuel could be seized until the large fine is paid).

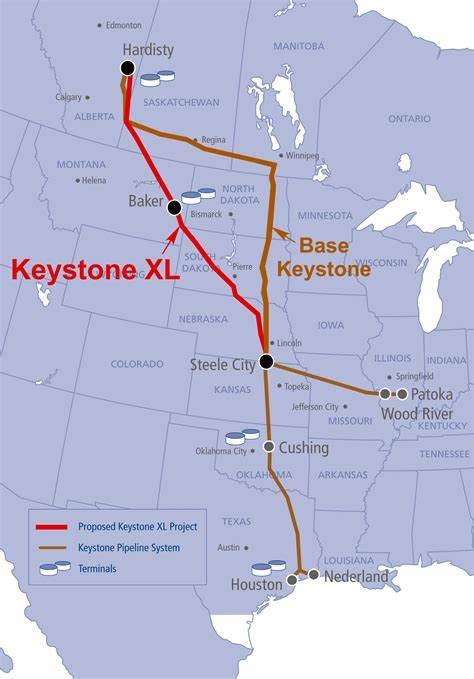

Several factors combined to deplete U.S. distillate inventories, which include diesel fuel, heating oil, and jet fuel. One is that distillate refining capacity has declined, especially on the East Coast. A key factor causing declining refining capacity on the East Coast was the Biden decision to halt construction of the Keystone Pipeline, which would have brought Canadian heavy-sour crude oil to the East Coast as well as Gulf Coast refineries, both of which are starved for heavy-sour crude. Most of these refineries were built in the 1970s to process heavy-sour crude oil because the U.S. was importing two-thirds of its crude oil from OPEC members, Venezuela, and Canada, all of which exported heavy-sour crude oil.

Another key reason for the declining number of refineries on the east coast is the lack of pipeline capacity to get crude oil to the refineries. Every new pipeline project in the U.S. has been sued by anti-fossil fuel NGOs which stops construction and ties up pipeline projects for years. In many cases, the court costs and wasted time result in the projects being abandoned. The East Coast has not had a new pipeline in years.

The U.S. shale revolution revealed that the U.S. has abundant supplies of light-sweet crude oil, which is environmentally superior to heavy-sour crude oil. However, the U.S. Gulf Coast refineries still need ample supplies of heavy-sour crude oil to operate at maximum efficiency. Even though some refineries have been reworked and expanded to handle more light-sweet crude, they still cannot produce as much diesel fuel and other distillates when running lighter, sweeter crudes.

The same is true with East Coast refineries. They, too, were built to be most efficient when processing heavy-sour crude. These East Coast refineries needed the Keystone XL Pipeline as a source of that crude. Those refineries would have been able to get that crude oil through the eastbound leg of the Keystone XL Pipeline, which would have terminated at the Patoka Oil Terminal in Patoka, Illinois, where it would have interconnected with five major interstate pipelines.

But President Biden’s purely political decision to kill the Keystone XL Pipeline on the first day of his presidency is one of the key reasons why the Gulf Coast and East Coast refineries are now producing less diesel and heating oil and there is an impending shortage this winter.

U.S. refiners were offsetting the lack of heavy-sour crude problem by importing 700,000 barrels per day of crude oil, distillates, and other refined products from Russia. But those imports have slowed after the Biden Administration ordered a halt to Russian imports after Russia invaded Ukraine and will soon be zero.

U.S. refining capacity is now lower than before Covid, as operable refinery capacity shrank in 2021 for a second consecutive year to stand at 17.9 million barrels per day as of January 1, 2022, according to EIA estimates. U.S. refiners permanently shut down some refinery capacity at the start of the pandemic when fuel demand plunged.

As of June 21, 2022, only 125 refineries are operating in the United States, a decline of 127 refineries since 1982. Most of those have closed permanently but a few have been converted into biofuel refineries or plastic recyclers. It is easy to understand why refiners would close or convert: operating margins have been squeezed for years, and the Biden Administration told them not to make long-term investments because their products would not be needed in 5 or 10 years. The refineries listened.

Lower refinery capacity in the U.S. since the pandemic, seasonal maintenance at refineries globally, and a strike in France have all combined in recent weeks to create a shortage of middle distillates, not only in the United States but also worldwide. The world is also scrambling for diesel supplies, given the looming EU embargo on Russian fuel imports starting in early February. A diesel shortage and high prices do not bode well for the U.S. and the global economies, which would push both into deeper recessions soon.

In the U.S., distillate fuel inventories are about 20% below the five-year average for this time of year, according to the EIA’s latest weekly inventory report. The U.S. has 25 days of diesel supply in reserve as of October 31, 2022. According to CNBC, U.S. diesel reserves at the end of October have never been this low since 1951, with the Northeast exposed to low levels of diesel stocks. According to EIA data, East Coast refineries are pushing their facilities to the limit, with refinery utilization on the East Coast at 102.5% in the week of October 21st.

Nevertheless, distillate inventories are much lower than usual and diesel and heating oil prices remain high. This will increase overall inflation because high diesel prices will make all consumer goods, which are delivered by trucks and diesel-powered trains, and heating bills more expensive. The only silver bullet would be a warmer-than-normal winter which would reduce the demand for heating oil and make more diesel fuel available.

Longer-term, sane energy policy would prioritize reviving the Keystone XL Pipeline and fast-tracking new refineries.

Thank you for reading “Thoughts about Energy and Economics.” If you find these posts valuable, please subscribe for free so new articles will be delivered to your inbox. Also, please help expand our community by adding your “Like,” sharing this article with friends, and posting links on social media. Your support is appreciated. Ed Ireland

https://open.substack.com/pub/finiche/p/portfolio-insights?r=1s05vd&utm_medium=ios&utm_campaign=post