FTI Consulting: Unlocking Advanced Nuclear Investments in the U.S. Through Strategic De-Risking

Surging Electricity Demand and Need for Firm Power are Driving Renewed Interest for New Nuclear Investments

[My longtime friend and colleague from the Barnett Shale boom days, Steve Everley, with FTI Consulting, posted on LinkedIn this study by FTI Consulting on how nuclear power can help address the surging demand for electricity from data centers and related infrastructure.]

𝐓𝐨 𝐦𝐞𝐞𝐭 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐩𝐨𝐰𝐞𝐫 𝐝𝐞𝐦𝐚𝐧𝐝, 𝐭𝐡𝐞 𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬 𝐧𝐞𝐞𝐝𝐬 𝐭𝐨 𝐭𝐫𝐢𝐩𝐥𝐞 𝐢𝐭𝐬 𝐧𝐮𝐜𝐥𝐞𝐚𝐫 𝐞𝐧𝐞𝐫𝐠𝐲 𝐜𝐚𝐩𝐚𝐜𝐢𝐭𝐲. ⚛️ ⚛️ ⚛️

That's a key finding in new research out today from FTI Consulting, led by our in-house nuclear experts Enrique Glotzer and Larry Stone.

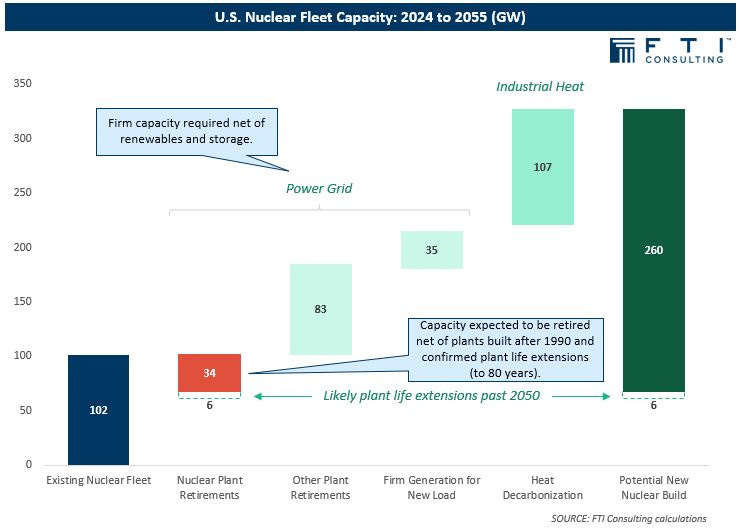

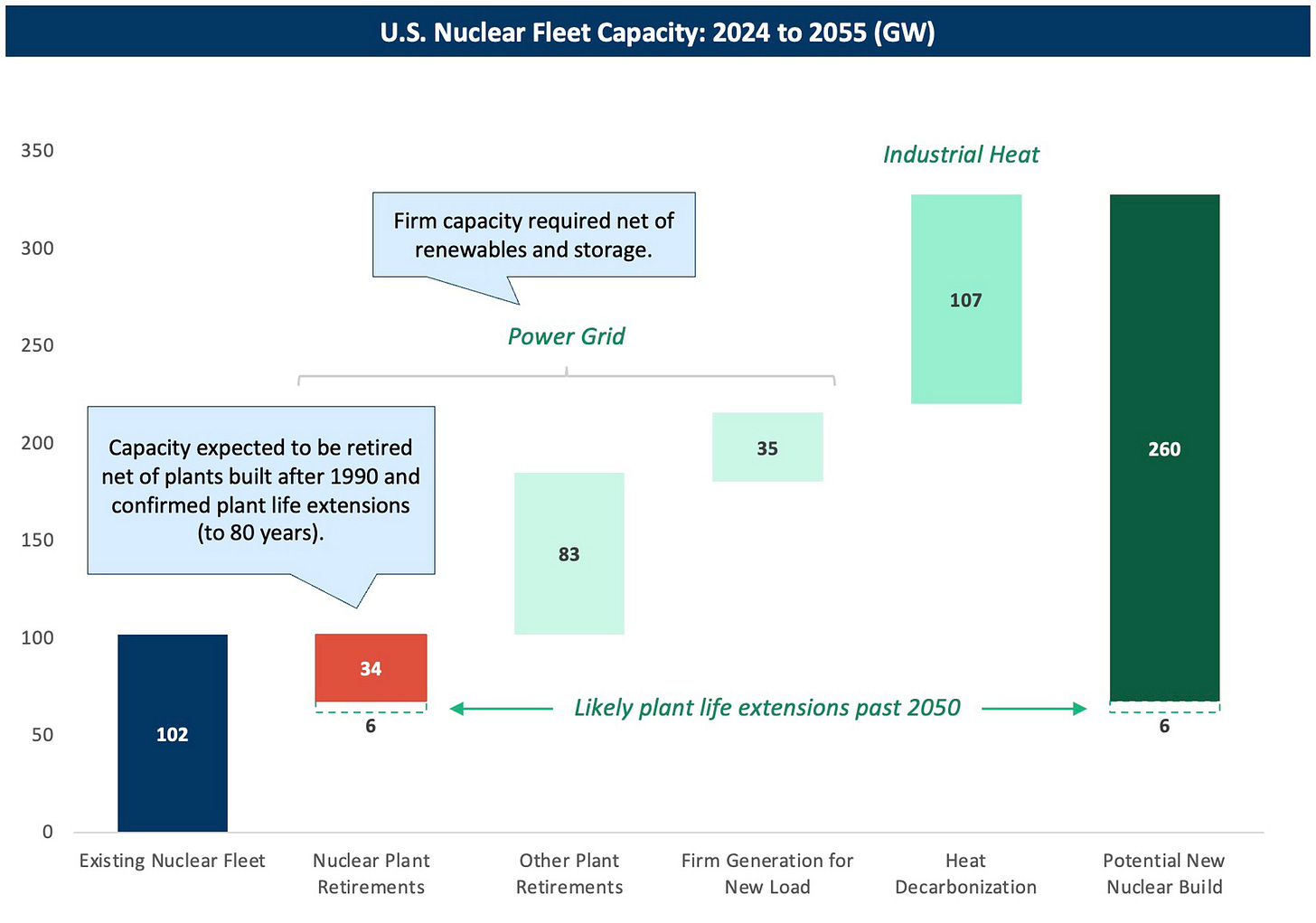

According to the analysis, the United States will need approximately 260 gigawatts (GW) of new hashtag#nuclearenergy capacity by 2055. Current capacity is just over 100 GW, and 34 GW is expected to be retired over that period.

To achieve that pace and scale of growth, it will require an investment of more than $1.8 trillion, or around $60 billion per year. For perspective, current investment levels are only about $4 billion per year.

That means investment in new nuclear needs to increase 15x to meet projected demand.

The link to the full analysis is in the comments, but here is a key excerpt:

"Driven by surging electricity demand from AI, data centers and electrification, the U.S. nuclear sector stands at a transformational inflection point. With strong policy support, advancing technologies and increasing investment momentum, advanced nuclear is emerging as a potential solution to meet firm, zero-carbon energy needs. Despite layered risks, strategic financing structures and proactive risk management enable investors to capitalize on this significant opportunity to reshape America’s energy landscape and unlock substantial growth potential over the coming decades."

Activate to view larger image,

[Complete report follows]

Surging Electricity Demand and Need for Firm Power are Driving Renewed Interest for New Nuclear Investments

U.S. power demand is growing faster than at any point in recent decades, with load forecasts increasing more than fivefold since 2022,1 ending two decades of stagnation. This surge is primarily driven by rapid growth in artificial intelligence (“AI”), data centers and cryptocurrency mining.2 Specifically, data centers are projected to account for 9% of national power consumption by 2030,3 significantly up from their share of 4% in 2023.4

Additional drivers include broad electrification across transport, buildings and industry, along with the reshoring of energy-intensive manufacturing, supported by industrial policies.5 Concurrently, gigawatts of coal capacity are being retired, and many aging gas plants will most likely follow suit. While renewables are rapidly expanding, their intermittent generation limits their ability to meet 24/7 baseload demand, particularly for large, always-on consumers such as data centers.

In this context, nuclear energy can offer a compelling solution. With an average capacity factor exceeding 92%,6 zero carbon emissions, and long asset lifespan, nuclear uniquely combines firm reliability with climate alignment, making advanced nuclear technologies increasingly attractive to investors and off-takers.

Supportive Policy, Technology Evolution and Market Pull Provide Further Tailwinds for Advanced Nuclear

Several other trends bolster interest in nuclear energy, including robust bipartisan support at both federal and state levels. Generous incentives provided by the Inflation Reduction Act (“IRA”)7 – although recent legislative activity in Congress has introduced some uncertainty about future incentive levels – substantial commitments from the DOE Loan Programs Office (“LPO”)8 and supportive state policies significantly mitigate project risks.9 The completion of projects, such as the Vogtle units in the U.S. and international deployments of large-scale reactors, have further boosted market confidence and provide evidence that may strengthen investor sentiment.

Advanced nuclear developers are focusing on smaller, standardized designs for factory fabrication and serial deployment, offering significant potential for lower cost and simpler financing vs. traditional large-scale projects. Though initial first-of-a-kind (“FOAK”) reactors face uncertainties, ongoing standardization and operational learning are expected to enhance cost and performance outcomes over time. All of this will play out over the next decade or so as various technologies try to move down their respective cost curves.

Critical for long-term success, next-gen reactor technologies extend beyond baseload electricity generation, offering additional grid services such as peaking capacity, flexibility, energy storage and applications for industrial heat, hydrogen production, desalination and district heating. Microreactors (below 50 MW) provide portable power and resilient off-grid solutions for military, mining and remote operations. Tech companies like Google and Amazon are emerging as key early adopters, providing financial support through long-term power purchase agreements (“PPAs”) and strategic investments.

Advanced Reactor Technology Categories and Costs

Advanced nuclear technologies build upon previous designs, aiming to enhance costs, safety and construction timelines, and can be categorized into four main groups:

Large Light Water Reactors (LWRs, Gen III+), such as the Westinghouse AP1000, range from around 1,100 MW to 1,700 MW. These reactors are technically proven but have historically experienced significant cost overruns and delays. Lessons learned from past projects and improved modular construction techniques could further reduce future costs, achieving Nth-of-a-kind (“NOAK”) costs around $6,000/kW,10 leading to lower levelized costs of energy (“LCOE”) — the total lifetime cost divided by total energy generation. Despite this lower unit cost, their large size still presents substantial capital risks, with multi-unit sites costing between $20 and $30 billion.

Small Modular Reactors (SMRs, Gen III+) range from roughly 50 MW to 470 MW. Designs such as Holtec’s SMR-300 and GE Vernova’s BWRX-300 employ technologies similar to LWRs but focus on reducing project scale to improve repeatability and simplify financing. Although initial pilots have encountered higher-than-expected costs, upcoming demonstration projects could significantly reshape market expectations if executed successfully. Despite their designs not being as mature as larger LWR counterparts, their technological similarity and substantially lower overall capital requirements make these reactors easier and more feasible to finance and develop.

Advanced Nuclear Reactors (ANRs, Gen IV), such as X-Energy’s HTGR and TerraPower’s Natrium, range in size from around 70 MW to 350 MW and use non-water coolants (i.e., gas, molten salts or liquid metals) that enable much higher temperatures — resulting in higher thermal efficiency, better safety from lower operating pressures, and capability to provide high-temperature heat and thermal storage (such as TerraPower’s Natrium). These technologies have higher capital costs driven by specialty nuclear fuels, advanced materials and additional balance-of-plant systems. Although ANRs may also have higher operational risks (i.e., capacity factors) and unit costs, they are designed with greater efficiencies and can generate additional value through grid flexibility, peaking capacity and heat applications leading to higher potential returns despite higher LCOEs than Gen III+.

Microreactors, typically under 50 MW (e.g., Westinghouse’s e-Vinci, Oklo’s Aurora) are small units suitable for portable power and off-grid applications. While having the highest LCOEs, their resilience and versatility offer substantial value for specific use cases, particularly in military, mining and remote operations.

Increasing New Nuclear Investment Activity in the U.S.

Large public and private investments are accelerating advanced nuclear projects. Notable investments include TerraPower’s $750 million fundraising,11 X-Energy’s $700 million funding round,12 and Google’s 500 MW PPA with Kairos Power.13 These strategic partnerships between corporations, private equity and institutional investors highlight the urgency for firm, zero-carbon generation and underscore the willingness to commit capital based on nuclear energy’s long-term potential.

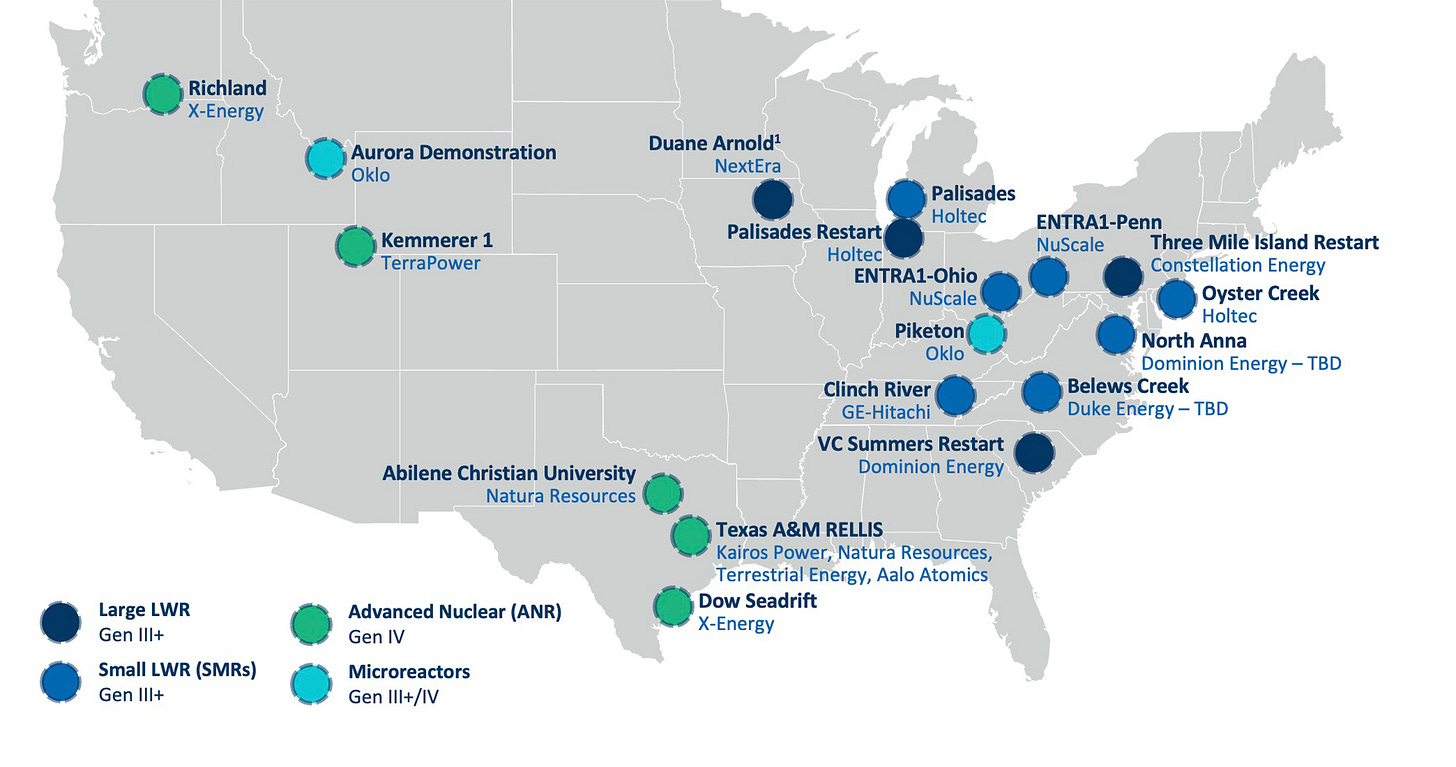

Significant recent developments include collaborations between Energy Northwest and Amazon, DOE’s Advanced Reactor Demonstration Program (“ARDP”) supporting TerraPower and X-energy14 and Texas’ proactive initiatives attracting multiple developers to the Texas A&M RELLIS campus (Fig. 1).15

Fig. 1: Announced New Nuclear Projects in the United States

Key Investment Risks for Developing New Nuclear

Investors must navigate several layered risks. Construction and cost overruns pose substantial risks, as seen with capital-intensive megaprojects like Vogtle and others. While smaller reactors reduce exposure, FOAK projects remain particularly vulnerable to technological complexity and incomplete designs, leading to uncertain timelines and costs.

Licensing and regulatory uncertainties, especially with the Nuclear Regulatory Commission (“NRC”), can pose delays leading to higher costs. Policy changes that might reduce government support, federal or state, could also significantly impact project economics. Technological immaturity, nascent supply chains, unproven reactor designs and limited operational experience heighten the potential for project and operational risks.

Supply chain vulnerabilities, particularly the current reliance on Russia for high-assay low-enriched uranium (“HALEU”)16 required by ANRs, introduce significant geopolitical and domestic supply chain risks. Market volatility driven by changes in power market and economic conditions over long development timelines adds another layer of financial risk. Finally, public opinion and political dynamics can also impact project duration and viability.

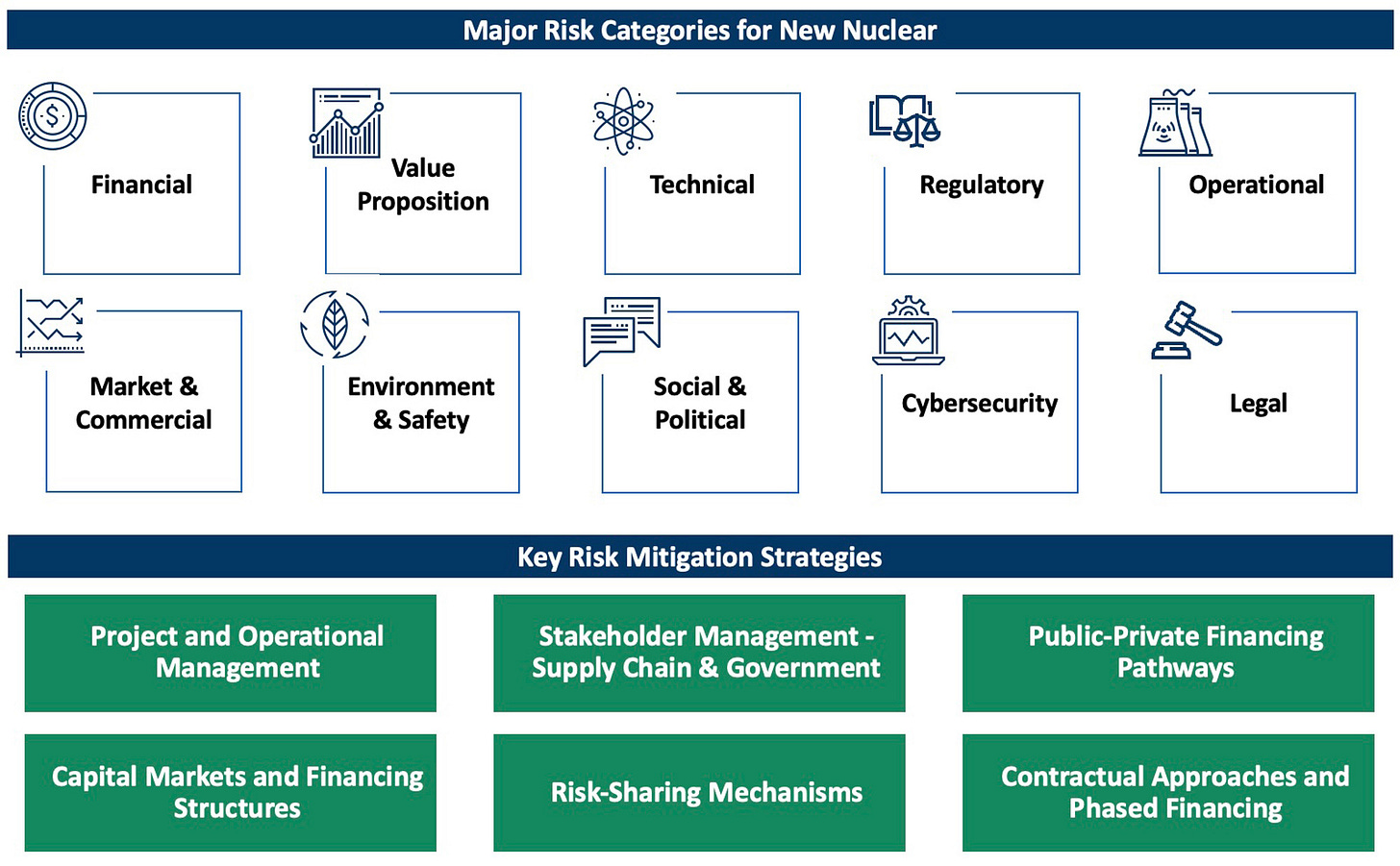

Fig. 2: Risk Identification and Mitigation Strategies for Nuclear

Structuring Financing Can Reduce Risk Exposure

Developers and investors are employing various strategies to mitigate risks and unlock capital. Federal support mechanisms, including DOE LPO loans, tax credits, and ARDP cost-sharing can significantly reduce capital expenditure and financial risks.

Long-term PPAs and capacity contracts with corporate and utility partners can help create and sustain predictable cash flows, facilitating project finance funding. Projects can employ joint ventures and consortia involving utilities, corporates, investors, suppliers and government entities to spread project risk and align stakeholder incentives, such as the Dow/X-energy and PacifiCorp/TerraPower partnerships.

Diversified funding that combines private equity, institutional capital and government loan guarantees can be structured to lower overall financing costs and reduce near-term liquidity pressures. Additionally, phased investments link funding releases to milestones so that investors can reassess risk and potentially secure better financing terms as the project derisks.

To encourage greater participation, investor education and innovative financial solutions are increasingly important to bridge the understanding gap regarding nuclear technology, regulatory complexities and market dynamics. Participation by experienced nuclear operators adds credibility and competitive advantage, enhancing the viability and attractiveness of investment. Finally, comprehensive financial risk planning that clearly maps investment paths from initial stages through commercial operations is critical for demonstrating long-term operational viability and profitability, supported by stable regulatory frameworks and policy environments.

Risk Mitigation Strategies Can Support New Nuclear

Effective risk management requires a multi-layered approach combining public-private partnerships, strategic alliances, tailored financing structures, and robust contracts (Fig. 2).

Project and Operational Management: Employ structured project management tactics with clearly defined milestones and accountabilities. Carefully select critical partners (e.g., fuel suppliers, EPC contractors) through robust due diligence, build strong in-house expertise, collaborate closely with partners possessing proven nuclear construction and operational experience and proactively address labor considerations by securing commitments from skilled workforce resources early.

Stakeholder Management: Establish supply chain alliances and negotiate multi-year agreements with reputable fuel and component suppliers to secure pricing stability, ensure timely delivery and manage inflation risks. Actively engage with regulatory agencies to streamline approvals, secure supportive policy environments and mitigate licensing uncertainties.

Public-Private Financing Pathways: Leverage special purpose vehicles (“SPVs”), government-backed loan guarantees and public-private partnerships (“PPPs”) to effectively distribute project risks, lower private-sector exposure and incentivize broader private capital participation. Create financial off ramps for various types of capital providers to reduce the overall cost of capital throughout the life of the project.

Capital Markets and Financing Structures: Utilize traditional project financing supported by long-term PPAs, alongside mezzanine or convertible debt instruments, yield-oriented investment vehicles (Yieldcos), asset-backed securitizations and sustainable finance instruments. This diversified approach helps attract a broad spectrum of investors, optimizes capital costs and enhances overall financial flexibility.

Risk-Sharing Mechanisms: Implement joint ventures, consortia structures, vendor financing contracts, integrated project agreements (IPAs) and phased milestone-based financing to allocate project risks among stakeholders. Clearly defined performance benchmarks, accountability measures and liquidity events embedded within these structures further reassure investors, clearly define value and enhance confidence in project execution.

Contractual Approaches: Secure long-term offtake agreements, phased funding commitments tied to specific milestones, and robust contractual terms addressing cost overruns, schedule delays, and performance guarantees. Clearly structured and enforceable contracts reduce financial risk, mitigate operational risks and provide greater assurance to investors and lenders.

Implementing these comprehensive strategies is essential to attract sustained investment and ensure the successful delivery of advanced nuclear projects.

The Nuclear Sector Is Expected to Grow Significantly

Meeting projected demand will require approximately 260 GW of new nuclear capacity by 2055, nearly tripling the current fleet (Fig. 3). This growth is critical for replacing retiring fossil fuel plants, meeting increased electricity demand and providing high-grade industrial heat for decarbonization. Nuclear power is also strategically positioned to support emerging sectors such as hydrogen production, water desalination and district heating.

Realizing this vision requires vast investments — estimated at over $1.8 trillion by 2055, or around $60 billion annually. Current investment levels (~$4 billion per annum) are insufficient, underscoring the urgent need for greater public and private investment, especially in supply chain development and commercialization.

Fig. 3: FTI Consulting U.S. Nuclear Fleet Capacity Forecast to 2055 (GW)17

Advanced Nuclear Economics Improve with Technology Maturity and Revenue Diversification

Economic outcomes for advanced nuclear projects deploying in the early 2030s vary significantly by reactor type, reflecting differences in capital requirements, technology risks and potential revenue streams. Early commercial deployments following FOAK pilots, often described as Beginning-of-a-Kind (“BOAK”), typically incur higher costs driven by technology maturity challenges, evolving reactor designs and nascent supply chains. However, substantial cost reductions are achievable as projects progress along the technology maturity curve toward NOAK deployments. With learning-curve progress and scaling, advanced nuclear technologies could see LCOE reductions from about $150/MWh (“FOAK”) to near $60/MWh (NOAK, inclusive of government incentives), making nuclear cost-competitive with other firm generation technologies.

LWRs offer the lowest mature unit capital costs. However, their substantial scale requires large upfront capital commitments (~$13 billion for two 1.1 GW units at ~$6,000/kW post-2030), significantly increasing absolute financial risk.

SMRs are expected to have higher unit costs until manufacturing efficiencies and supply-chain maturity improve. Nonetheless, shorter construction timelines, smaller scale and modular designs mitigate financing and execution risks, significantly reducing the absolute capital exposure (~$2-3 billion) vs. LWRs.18

ANRs using gas, molten salts or liquid metal coolants have the highest LCOEs driven by advanced fuels, specialized material requirements and additional balance-of-plant systems. Higher technology and operational risks stemming from limited commercial deployment history introduce additional uncertainties. However, ANRs uniquely offer diversified revenue streams not captured by LCOE alone, including flexible grid services, industrial heat applications and capacity market participation, enhancing overall project financial viability.

We evaluated the economic performance across the main nuclear technologies using our comprehensive financial model. Results indicate LWRs offer the narrowest ROI risk range,19 while ANRs exhibit the widest range but potentially highest returns due to additional revenues in certain scenarios, and SMRs sit roughly in between in terms of risk and returns.

A Transformational Opportunity in Nuclear Energy

The nuclear sector is at a major inflection point, driven by rising electricity demand, decarbonization efforts, retiring fossil generation and evolving energy market dynamics. Strong policy frameworks, committed corporate engagement, innovative reactor technologies and sophisticated financing structures position advanced nuclear as a pivotal clean energy solution.

Investors who strategically manage risks and leverage robust financial and operational frameworks stand poised to capitalize on this transformational opportunity, significantly reshaping America’s energy landscape for decades to come.

Footnotes:

1: John D. Wilson, Zach Zimmerman, and Rob Gramlich, “Strategic Industries Surging: Driving US Power Demand,” Grid Strategies (December 2024).

2: “AI is set to drive surging demand from data centres while offering the potential to transform how the energy sector works,” IEA (April 10, 2025).

3: “EPRI Study: Data Centers Could Consume up to 9% of U.S. Electricity Generation by 2030,” EPRI (May 29, 2024).

4: “DOE Releases New Report Evaluating Increase in Electricity Demand from Data Centers,” Department of Energy (December 20, 2024).

5: John D. Wilson, Zach Zimmerman, and Rob Gramlich, “Strategic Industries Surging: Driving US Power Demand,” Grid Strategies (December 2024).

6: “What is Generation Capacity,” Department of Energy (March 30, 2025).

7: “Inflation Reduction Act Keeps Momentum Building for Nuclear Power,” Department of Energy: Office of Nuclear Power (September 8, 2022).

8: “DOE Approves Loan Disbursement for Palisades Nuclear Plant,” Department of Energy Loan Programs Office (March 17, 2025).

9: “Start of 2025 Sees Flurry of State Legislative Actions Tied to Nuclear Power,” American Public Power Association, (April 9, 2025).

10: “Pathways to Commercial Liftoff: Advanced Nuclear,” Department of Energy (September 2024).

11: “TerraPower Announces $750 Million Secured in Fundraise,” TerraPower (August 15, 2022).

12: “X-energy Closes Upsized $700 Million Series C-1 Financing Round to Accelerate the Development of Advanced Small Modular Nuclear Technology,” X-energy (February 6, 2025).

13: “Google and Kairos Power Partner to Deploy 500 MW of Clean Electricity Generation,” Kairos Power (October 14, 2024).

14: “U.S. Department of Energy Announces $160 Million in First Awards under Advanced Reactor Demonstration Program,” Department of Energy: Office of Nuclear Power, (October 13, 2020).

15: “Texas A&M System Goes Nuclear,” Texas A&M University, (February 4, 2025).

16: HALEU — enriched to between 5% and 20% U-235 — is currently only commercially produced by Russian state-owned enterprise Rosatom; however Centrus (U.S.) is in development of a commercial HALEU production facility.

17: Analysis based on expectations of current fleet nuclear retirements, fossil retirements, load growth and industrial decarbonization needs.

18: As noted above, the LWRs analysis reveals about ~$13 billion for two 1.1 GW units at ~$6,000/kW post-2030 while the SMR analysis is for one 300 MW unit at ~$8,000/kW post-2030.

19: Our team identified, quantified and analyzed key risks and flexed our comprehensive project finance model through 10 risk scenarios adjusting key variables and accounting for varied revenue streams across technology types. Analysis is based on an Internal Rate of Return with a WACC of 12% and a 70:30 debt to equity split assuming receipt of a DOE LPO loan.

Thank you for reading “Thoughts about Energy and Economics.” This publication is reader-supported, so please “like” it, share it with friends and colleagues, and become a paid subscriber. Your support is greatly appreciated!