ERCOT Has A Plan to Improve Texas Power Grid Reliability

Renewables have destabilized power grids, especially in Texas

When it comes to energy, Texas is unique. Texas is the largest crude oil and natural gas-producing state in the nation, thanks to Texas oilman George Mitchell’s tenacity in figuring out how to get natural gas and crude oil out of dense shale rock using hydraulic fracturing. If Texas were a country, it would be the world's third-largest natural gas producer and the fourth-largest oil producer. Texas also produces more wind power than any other state.

Texas ranks first in the nation in installed wind energy capacity, generating more wind power than the next three most prolific wind energy states combined, and has done so for 16 years in a row. Compared to other countries, Texas is the fifth largest wind power producer.

The electricity grid in Texas is also unique. Texas is the only State with a grid that is not connected to other grids. Texas produces more electricity than any other state, generating nearly twice as much as Florida, the second-largest generating State. Texas accounts for about 12% of the nation’s total electricity generation.

Texas has also been a leader in deregulating its electricity grid. In 1995, Texas broke the mold of public utility-type integrated electricity grids, transmission lines, and local utilities, which characterized the electricity industry. With the passage of Senate Bill 373, the Electric Reliability Council of Texas, or ERCOT, became the country’s first independent system operator (ISO) and was required to grant all power generators access to transmission lines to foster competitive electricity generation and distribution. In 1999, the Senate passed Bill 7, referred to as “The Price to Beat Bill,” designed to prevent underselling electricity by establishing a price floor for electricity resellers.

In 2002, the Public Utility Commission made ERCOT an independent body, charging them with maintaining the wholesale and retail market. At that point, electricity generation and distribution in Texas became the least regulated in the U.S. As a result, Texas electricity consumers have been able to choose their electricity provider online from a list of over 100 resellers and independent generators authorized to sell electricity into the ERCOT grid.

This free-market approach to the Texas electricity grid worked relatively well until Winter Storm Uri hit Texas and much of the U.S. on February 14, 2021, lasting five days. With temperatures below freezing and near or below zero in much of the State, about half of the electric generation facilities encountered weather-related problems and reduced their generation or dropped off the grid completely. The Texas power grid was 4 minutes and 37 seconds away from total collapse in February 2021, which could have left the 30 million residents of Texas without electricity for weeks or even months. Approximately 200 deaths and billions of dollars in property damage were attributed to power outages.

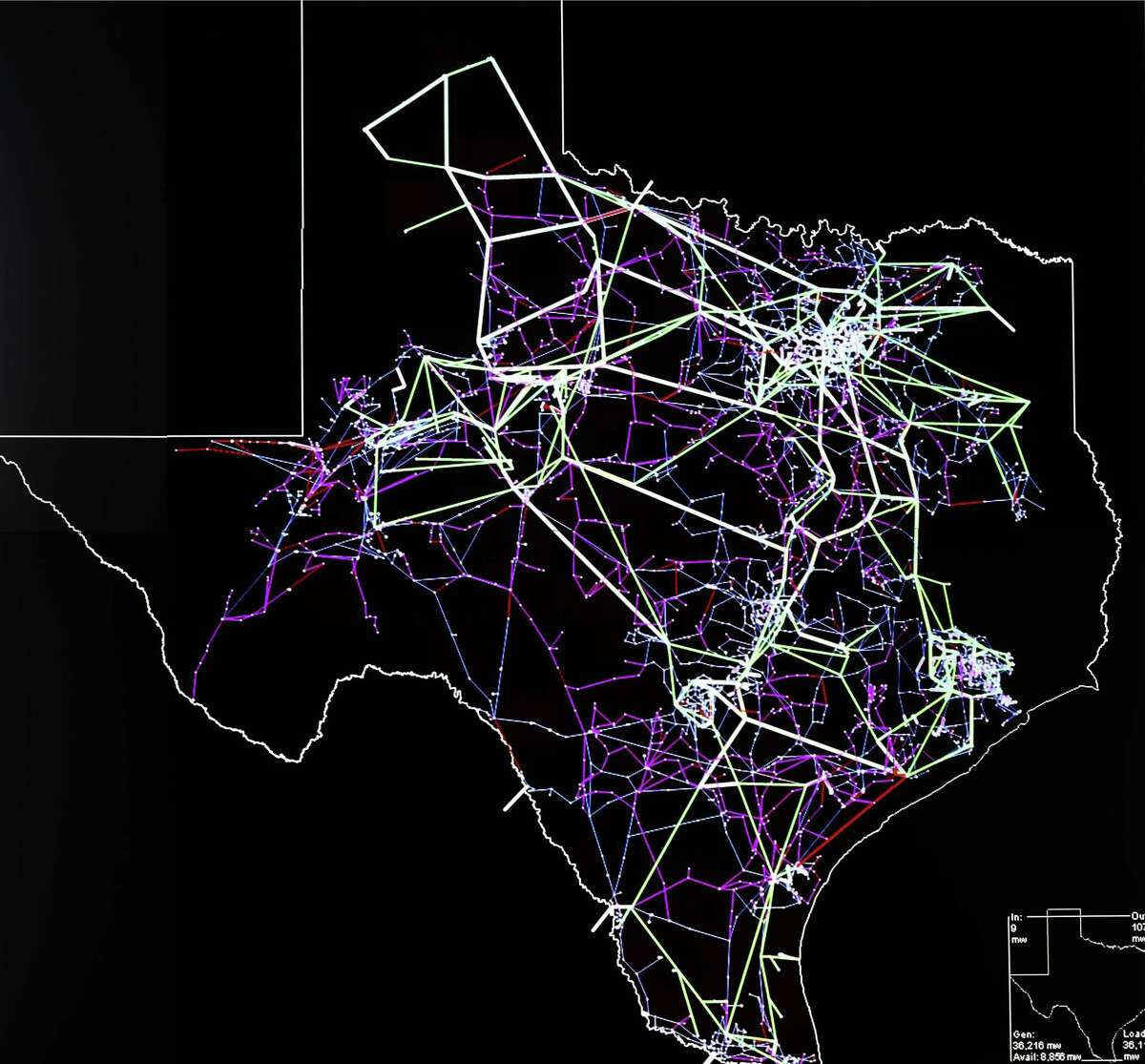

Fast forward to Winter Storm Mara, which hit Texas on January 29, 2023, and lasted five days. Temperatures dropped into the lower 20s, the clouds moved in, and ice storms were almost continuous for four days. Mara was not nearly as bad as Winter Storm Uri, but the impact on the power grid was similar. Combined wind and solar generation drop to 10% or less, as seen below in this ERCOT Dashboard screenshot on January 31, 2023, while natural gas, coal, and nuclear produce over 90% of the state’s power. ERCOT has handled such drastic drops in wind and solar because so much natural gas generation is available. Natural gas-powered generation essentially acts as the “battery” to back up unreliable wind and solar. But with the addition of more and more wind and solar power due to generous federal subsidies, maintaining a reliable grid has become increasingly difficult during severe weather events.

ERCOT is an “energy-only” market, unlike most other grids that are “capacity markets,” which pay for standby generation capacity. When wind and solar decline or fail, ERCOT depends on natural gas-generated power to show up, but generators are not obligated to do so. Winter Storm Uri emphasized that power generators may not have enough power to replace the lost wind and solar power, putting the grid in peril. ERCOT had always assumed that the compensation to generators for maintaining reserves of power was receiving the marginal price, which is capped at $9,000 per megawatt hour, but that assumption is now being questioned.

ERCOT’s investigation of the grid failures of Winter Storm Uri led to retaining the consulting firm Energy and Environmental Economics, Inc., referred to as E3, for “consulting services related to analysis, development, and implementation of market design and market structure changes in Electric Reliability Council of Texas (ERCOT) wholesale market.” In their final report, E3 listed five new market design options, and ERCOT chose the Performance Credit Mechanism (PCM). Under the proposed new rules, dispatchable power generators, such as natural gas and coal, or wind and solar generators, if they invest in battery storage, would be rewarded by receiving “performance credits.”

These “performance credits” could be monetized by allowing 3rd party resellers of power to “buy” them, which would give the resellers the means to improve their reliability to their customers. This mechanism seems like it would be a "win-win for all levels of the Texas power market while significantly improving grid reliability. In effect, the PCM is a mechanism for ERCOT to have the benefits of a capacity market while having someone else pay for it. This is a very innovative plan but will need to be market tested.

Some members of the Texas Legislature expressed concern that the PUC and ERCOT are moving too quickly and passed a bill that, in effect, told the PUC to stop implementing the PCM until the Legislature can evaluate its path forward. PUC said they would do that, but realistically, the Legislature will not be able to agree on a different proposal from the PCM before the legislative session ends on May 9, 2023. The likely outcome is that the Legislature will support the Performance Credit Mechanism as recommended by the PUC so that ERCOT can get a pilot project underway.

Another interesting variable between Uri and Mara is the growth of Bitcoin Mining in Texas over the course of the past 2 years: ~600MW in 2021 to >1600MW more recently. Because miners consume power only when cost is less than their breakeven (~$50-$70/MWh), they effectively act like a generator, who would only generate on when costs is greater than their breakeven $/MWh cost. Having a loadside resource with these aligned operational features is pretty cool. Obviously can't pass cause/effect judgement, but worth thinking about IMO. Timestamp 30ish min: https://www.youtube.com/watch?v=MkB_9P9tnFI