Energy Factoid: U.S. natural gas prices expected to increase

According to the Energy Information Administration

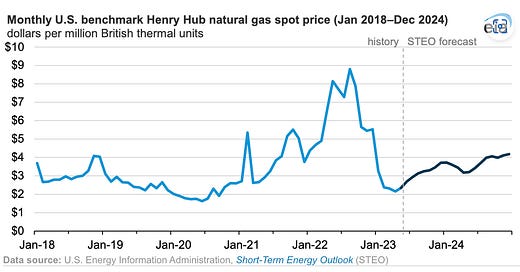

U.S. natural gas producers have had a tough year, with gas prices dropping from $9 per MMBtu (million British thermal units) in mid-2022 to near $2 per MMBtu in 2023. But according to the latest Short-term Energy Outlook May 2023 released by the U.S Energy Information Administration (EIA), market conditions will start improving soon.

EIA projects that the Henry Hub spot price for natural gas will increase from its recent low of $2.16 per MMBtu, and continue increasing for the remainder of 2023, reaching $3.71 per MMBtu in December.

The boost in natural gas prices results from increased domestic electricity demand and LNG exports, while dry natural gas production declines due to the relatively low prices. In addition, EIA is forecasting a warmer-than-normal summer, with U.S. electricity generation reaching 38 billion cubic feet per day (BCF/d), the second highest on record behind last year.

Upward pressure on natural gas prices will also come from increased LNG exports which are expected to grow for at least the next two years.

LNG exports are expected to increase from the first quarter average of 11.6 Bcf/d to 12.2 Bcf/d this summer as Europe builds its LNG inventories for the 2023-2024 winter. In addition, due to increased demand and reduced natural gas production, EIA expects less natural gas to be injected into domestic storage this summer, resulting in lower-than-average storage levels. This will set the stage for upward pressure on natural gas prices going into the winter of 2023-2024.

While natural gas producers will benefit from the higher prices, home heating bills should not increase significantly, according to EIA, because the weather projection they rely on from the National Oceanic and Atmospheric Administration, combined with a 30-year trend line, predicts that this coming winter will be warmer than usual.

Bottom line: While natural gas prices may increase slightly from the recent lows, they will likely be constrained by associated natural gas production from U.S. shale crude oil production, which is expected to continue rising at least thru 2024, according to the EIA:

Thanks for this data!